What do you do when you want to take digital currency from one network and use it on another? At the moment, you can swap your crypto for the type you need on an exchange, however, this action will cost you time and money.

Bridging is a far more efficient way to transfer assets between different blockchains. Inherently serving decentralization, bridges are on a quest to solve cryptosphere’s most painful problem – the lack of interoperability.

Let’s see why this is important:

The Challenge

The significance of blockchain bridges lies in the inability to use crypto without limitation. This means that without using a third service you can’t freely perform cross-chain operations. An Ethereum coin, for instance, won’t be compatible with Solana or Bitcoin blockchains.

To get more specific, if you intend to lend Cardano on Polygon you should connect the two via a bridge technology. This way the amount of Cardano you’d like to transfer will be locked, or in crypto language, “wired” into a token representing the same value on Polygon. Then, you can take advantage of Polygon’s capabilities.

Another case in which blockchain bridges come into play is when you decide to own the native token of a network (e.g. BTC on Bitcoin, ETH on Ethereum). As a reference, we can use a scenario that Ethereum describes on their platform: a user wants to gain exposure to BTC on Ethereum. He can buy Wrapped Bitcoin (WBTC). However, WBTC is an ERC-20 token native to the Ethereum network, which means it’s an Ethereum version of Bitcoin and not the original asset on the Bitcoin blockchain.

To own a native BTC, he has to bridge his assets from Ethereum to Bitcoin using a bridge. This will bridge his WBTC and convert it into native BTC. Alternatively, he might own BTC and want to use it in Ethereum DeFi protocols. This would require bridging the other way, from BTC to WBTC which can then be used as an asset on Ethereum.

Types of Blockchain Bridges

- One-way and two-way – as their names suggest, some bridges are only passing data from one blockchain to another in a single direction, while others go back and forth.

- Centralized or decentralized – ironically, despite bridges being a substantial factor in driving decentralization, some of them still remain centralized or based on trust. They require a mediating entity to run and can be faster and cheaper when transferring large quantities of crypto. On the downside, they are not designed to prevent fraud.

Alternatively, trustless bridges rely on peer-to-peer interactions and depend on machine algorithms which makes them more flexible and secure.

Blockchain bridges can be separate services linking independent networks, or they can be in-built on the blockchain platform itself. Such bridges are Binance Bridge and the Polkadot bridges.

Who Needs Them and Why?

Everyone who participates in the crypto economy – users utilize bridges to extend their reach and multiply trading, staking, and lending possibilities. Simultaneously, blockchain developers integrate the technology to allow the same possibilities. In other words, it’s a win-win agreement to evolve together.

Having said that, the most common reason for bridging up to this date is to reduce additional transfer fees. To illustrate that, a regular Ethereum transaction costs around $20 compared to other blockchain transactions that cost as little as $0.05.

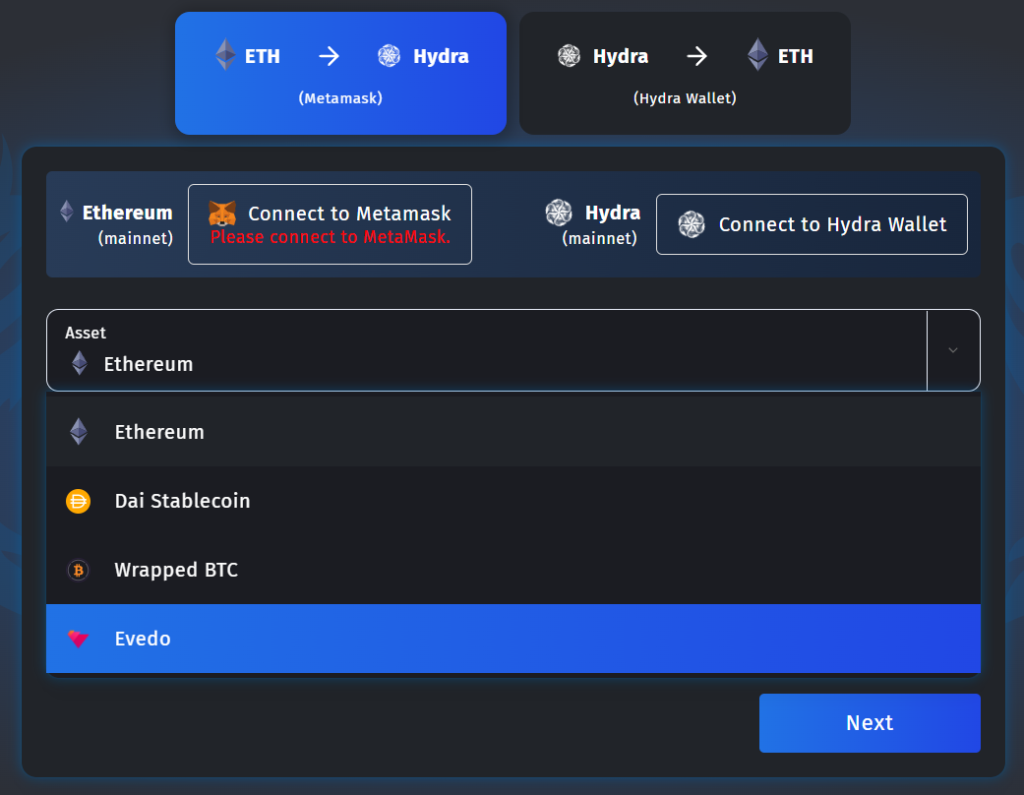

To make a parallel with Evedo, last week we hit a major milestone for us by migrating our native token from Ethereum to Hydra chain. In other words, from now on, if you are an $EVED holder, you can bridge over your tokens to the Hydra ecosystem through the Hydra/Ethereum Bridge.

How Will Blockchain Bridges Develop

According to recent data, in 2021, bridges to Ethereum now exceed $7 billion and this growth tendency is going to continue.

Blockchain bridges are extremely important for the industry and yet, they are exceptionally complex technologies. Similar to crypto exchanges, the most dangerous threat to bridges comes from hackers’ attacks. A few cases that include popular cross-chain services became public and a lot of money was lost, not to mention the reputational harm caused. Therefore, the critical task that stands in front of blockchain bridge providers, is to achieve an optimal level of security. Until then, study the bridges you’re going to use carefully – read reviews, weigh the pros and cons, and play it safe.

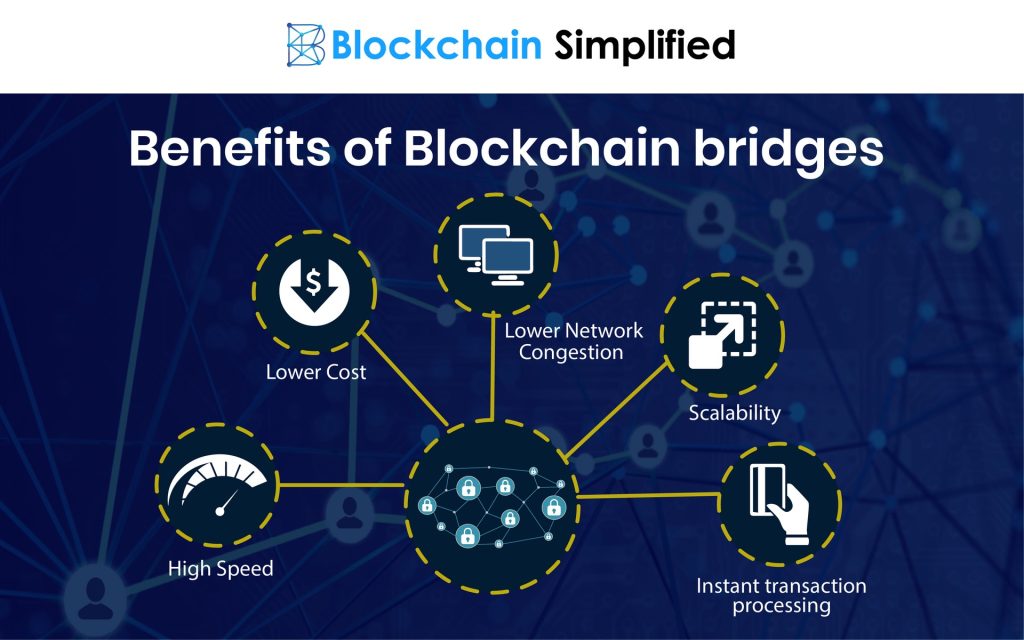

Bridges help to scale crypto services and benefit from better functionalities, more advanced applications, and lower fees. Highly accessible, they save time with each crypto transaction. Eventually, delivering a multi-chain market structure will transform the whole crypto economy and will navigate its progression by combining the best characteristics of the various networks.

Keep an eye on our future content and blog posts to learn about all the exciting things you can do with Evedo‘s and Fragmint‘s native tokens to other exciting blockchains:

Website: www.evedo.co

Email: info@evedo.co

Telegram: https://t.me/evedoco

Facebook: https://www.facebook.com/evedo.co

Twitter: https://twitter.com/evedotoken

Reddit: https://www.reddit.com/r/Evedo

Instagram: https://www.instagram.com/evedo.co